can i gift more than the annual exclusion

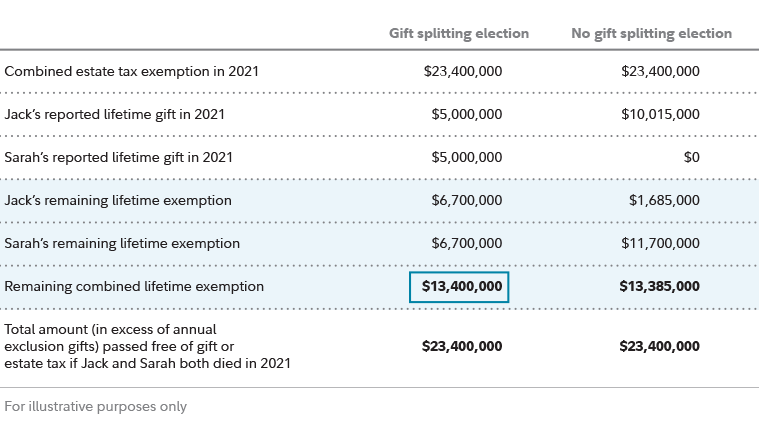

Furthermore the woman and her spouse can continue gifting each of them the maximum gift exclusion year after year. For example if you gift someone 20000 in 2021 you will have to file a gift tax return for 5000 which is the amount over the annual exclusion.

Gift Tax In 2021 How Much Can I Give Tax Free The Motley Fool

This gift tax limit isnt a cap on the total sum of all your gifts for the year.

. Keep in mind that the annual exclusion applies per individual which means you can gift significantly more than 15000 per year so long as its given to multiple people or organizations. The exception to this rule falls into place if you do give more than the lifetime exclusion allowance. Recipients generally never owe income tax on the gifts.

GiveCentral provides nonprofits with the ability to allow their donors to give quickly and securely. GiveCentral works with over 1100 nonprofits nationwide to increase giving and expand the donor community. That means an individual can leave 1158 million to heirs and pay no federal estate or gift tax while a married couple will be able to shield.

But if you go over that limit for any individual or entity. After 2021 the 15000 exclusion may be increased for inflation Say you give two favored relatives 20000. Remember the annual gift tax exclusion amount also includes non-529 gifts so be sure to include any cash or property gifts in your total.

Our software includes world-class accounting member-management and communication tools. If youre married you and your spouse can each gift up to 16000 to any one recipient. An indirect bequest of assets to a beneficiary by means of a special legal and fiduciary arrangement.

This means a married couple has a combined annual gift exclusion of 32000 per recipient. For example say someone gives you 20000 in one year and you and the giver are both single. In 2022 an individual can leave 1206 million to heirs and pay no federal estate or gift tax while a married couple can shield 2412 million.

The annual gift tax exclusion is 16000 per recipient in 2022 32000 for a married couple giving jointly and 15000 in 2021. If you give 17000 each to. The annual gift exclusion limit applies on a per-recipient basis.

The purpose of a gift. That still doesnt mean they owe gift tax. The annual federal gift tax exclusion allows you to give away up to 15000 each in 2021 to as many people as you wish without those gifts counting against your 117 million lifetime exemption.

If you and your spouse make a gift jointly the exclusion is 30000. You just cannot gift any one recipient more than 16000 within one year. If your total gifts to an individual will be more than 16000 this year the excess amount will count against your lifetime estate and gift tax exemption and will have to be reported on Form 709 when you file your taxes.

Gift In Trust. For instance you can give up to the annual exclusion amount 15000 in 2021 to any number of people every year without facing any gift taxes. So you can give 15000 in cash or property to your son daughter and granddaughter each without worrying about a gift tax.

At that point not only will you have to. If the parent has. Donors can give via text desktop phone or tablet.

If someone gives you more than the annual gift tax exclusion amount 15000 in 2019 the giver must file a gift tax return. Some examples of situations that could trigger someone having to file a gift tax return include. Taxpayers dont have to file a gift tax return as long as their total gifts are less than the annual gift tax exclusion amount per recipient.

Lifetime Gift Tax Exclusion. You can make individual 16000 gifts to as many people as you want. During the life of such beneficiary no portion of the corpus or income of the trust may be distributed to or for the benefit of any person other than the beneficiary and if the trust does not terminate before the.

The giver must file a gift tax return showing an excess gift of 5000 20000 15000 exclusion 5000. If someone gives you more than the annual gift tax exclusion amount 15000 in 2020 the giver must file a gift tax return. In order for a gift in trust to qualify for the GSTT annual exclusion the trust must be for a grandchild or more remote descendant and must have the following terms.

This applies per individual. Each parent may give a child up to 56 million during the parents lifetime as a tax-free gift. The annual gift tax exclusion provides additional shelter.

How gift tax is calculated and how the annual gift tax exclusion works In 2021 you can give up to 15000 to someone in a year and generally not. In 2022 as long as the gift is not greater than 16000 per recipient 32000 in the case of a married couple it does not have to be reported to the. For 2019 and 2020 the annual gift tax exclusion sits at 15000.

In addition to the annual gift amount your can give a total of up to 117 million in 2021 in your lifetime before you start owing the gift tax. For 2022 the limit is 16000.

Gift Tax The Annual Exclusion And Estate Planning The American College Of Trust And Estate Counsel

What Is The Lifetime Gift Tax Exemption For 2021 Smartasset

Gift Tax Exclusion For Tuition Frank Financial Aid

A Tax On Giving Understanding The Rules

What It Means To Make A Gift Under The Federal Gift Tax System Agency One

Use The 2016 Gift Tax Exclusion To Beat The Estate Tax The Motley Fool

Annual Gift Tax And Estate Tax Exclusions Are Increasing In 2022

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free

Locking In The 12 Million Gift Tax Exclusion

How To Make The Most Of The Annual Gift Tax Exclusion Cpa Firm Tampa

What Is The Lifetime Gift Tax Exemption For 2021 Smartasset

How Much Money Can You Gift Tax Free The Motley Fool

What Is The Lifetime Gift Tax Exemption For 2021 Smartasset

Take Advantage Of The Gift Tax Exclusion Rules Miller Kaplan

What Is The Gift Tax Exclusion For 2017 Cipparone Zaccaro

Do I Have To Pay Taxes On A Gift H R Block

/christmas-cash--wad-of-american-currency-tied-with-red-ribbon-611319628-ab2093a9addf4a46b6a54817e5eaee21.jpg)